Recently passed legislation (Medicare Access and CHIP Reauthorization Act of 20151) will, among other things, affect the Medicare Supplement industry in calendar year 2020 in terms of what can’t be covered—namely the Part B deductible. Currently, the Part B deductible is only covered under two standardized Medicare Supplement plans, C and F. And the estimated benefit value is less than 10% of the total coverage. The Part B deductible in calendar year 2016 is only $166.

So why was there such interest in the Part B deductible as part of this new legislation? The primary reason is that this deductible represents first-dollar coverage for Medicare enrollees who are covered by Plan F. And with coverage of the Part B deductible, Plan F basically covers all of the Medicare beneficiary obligations. There is a school of thought that this level of “blanket” coverage encourages, or at least doesn’t discourage, discretionary and unnecessary utilization of physician services, which contributes to the level of Medicare expenditures we see today. Note that this also applies to Plan C, which has very minor benefit differences from Plan F. Plan F is the industry leader in terms of current in-force. Therefore, for purposes of this discussion, we will focus on Plan F.

Regardless of the reasoning, the new legislation will have interesting ramifications for Medicare Supplement carriers to evaluate as work is underway to draft updated regulation.

- From a marketplace perspective, Plan F will no longer be an option for individuals newly eligible for Medicare2.

- It appears that in-force policyholders will be able to keep their current versions of Plan F.

- It appears that individuals eligible for Medicare prior to January 1, 2020, can purchase the current version of Plan F on or after January 1, 2020.

For the purposes of this research report, we will focus on the first item and how it will change the Medicare Supplement landscape. Then we will discuss how typical current rating practices in the industry align with the actual benefit relationships. Given pending legislation and the need to prepare for changes, this may be the time to reevaluate and possibly modify old rate structures.

So what's the deal with plans F and G?

For the last few years, Plan G has become a popular option in the market. What isn’t clear is why this is a relatively new development. What is clear is that, in most cases for a given carrier, the difference between annual premium rates of Plans F and G exceed the Part B deductible. This creates a situation where potential applicants would definitely be better off purchasing Plan G. Even if the applicant is subject to the Part B deductible, it’s still a better deal than purchasing Plan F in this situation. However, there are rational reasons for the differential between Plans F and G to exceed the Part B deductible. Possible reasons are as follows:

- The premium includes company retention for commissions, expenses, and profit.

- The relatively simplified pricing process common in the industry applies aggregate factors to base rate relativities. This can cause discrepancies, especially in high-cost areas and older ages.

- Plan F (but not Plan G) must be available for those individuals who qualify for various guaranteed issue rights beyond open enrollment at age 65. Some carriers might incorporate an additional morbidity load to reflect those extra guaranteed issues not subject to medical underwriting.

- The Part B deductible is on a calendar year basis while Medicare Supplement policies can be paid on a monthly basis and the first year exposure (especially for age 65) can be less than a full year.

How should plan G be priced for 2020?

With respect to individuals “newly eligible” for Medicare on or after January 1, 2020, Plan F will not be available. Plan G will take the mantle as the richest, and presumably most popular, plan of choice. What considerations and approaches should carriers take in pricing Plan G under this new environment? This is a question that carriers will need to grapple with. It may depend on the previous rating structure of both plans and provides an opportunity to revisit and modify. But to base a new structure on the current Plan F slope, which is likely to consist of previous company experience dominated by Plan F, could introduce certain biases and misalignment of the rates and claim costs.

Given the relatively fixed Part B deductible benefit, one would expect the Plan G age slope to be steeper than that of Plan F. We find this to be generally true based on internal research and analysis of the Centers for Medicare and Medicaid Services (CMS) Medicare 5% sample data set (years 2011 to 2013). The table in Figure 1 provides gender-specific claim cost age slopes for Plan F and Plan G benefits.

Figure 1: Estimated Claim Cost Age Slopes Based on CMS 5% Sample (2011-2013)

| Plan F | Plan G | |||

| Age | Male | Female | Male | Female |

| 65 | 100% | 100% | 100% | 100% |

| 70 | 120% | 107% | 129% | 115% |

| 75 | 149% | 127% | 162% | 138% |

| 80 | 174% | 145% | 190% | 159% |

| 85 | 198% | 164% | 217% | 182% |

Our analysis uses Medicare data across all Medicare enrollees included in the 5% sample data set and does not segment actual Medicare Supplement policyholders or in particular policyholders of Plan F or Plan G.

Companies without Plan G experience might decide to reduce current Plan F rates to arrive at Plan G rates. So what are the implications of pricing Plan G with a current Plan F rate slope? We provide a simple case study demonstration. For purposes of this case study, we assume the company correctly recognizes the overall benefit difference assumption—in this case, approximately 92% for purposes of this sample case study. We also assume the company prices to a 77.0% lifetime loss ratio. Assume sample current Plan F age-gender rates as shown in the table in Figure 2.

Figure 2: "Current" Plan F Sample Monthly Premium Rates

| Age | Male | Female |

| 65 | $148.19 | $134.72 |

| 70 | 178.20 | 162.00 |

| 75 | 209.40 | 190.37 |

| 80 | 232.44 | 211.31 |

| 85 | 258.00 | 234.55 |

For simplicity, we show only every five ages. The sample rate levels are provided for demonstration purposes only. Actual results will vary based on the complete rate schedule and various pricing assumptions, such as, but not limited to, persistency, issue age distribution, and discount rate. A discussion of appropriate assumptions is beyond the scope of this paper as the intent is to show reasonable impact. The assumptions used in this case study are provided in Appendix A.

If the current Plan F rates are adjusted by the same percentage across the board for the removal of the Part B deductible, the resulting reduced Plan G rates are shown in the table in Figure 3.

Figure 3: Plan G, Reduced Sample Monthly Premium Rates

| Age | Male | Female |

| 65 | $135.92 | $123.57 |

| 70 | 163.44 | 148.58 |

| 75 | 192.07 | 174.61 |

| 80 | 213.19 | 193.81 |

| 85 | 236.64 | 215.13 |

However, if the expected Plan G age slope and gender relativities are reflected in both the claim cost assumptions as well as the age rate slopes, the resulting repriced rates are shown in the table in Figure 4.

Figure 4: Plan G, Repriced Sample Monthly Premium Rates

| Age | Male | Female |

| 65 | $127.19 | $115.63 |

| 70 | 157.58 | 143.26 |

| 75 | 189.57 | 172.34 |

| 80 | 219.51 | 199.55 |

| 85 | 255.75 | 232.50 |

In comparison with the discounted base rates in Figure 3, the repriced rates in Figure 4 more closely follow the expected steeper claim cost age slopes and are more aligned from an actuarial equivalence perspective. And resulting byproducts are the approximately 6.5% lower rates at the key younger attained ages and the approximately 8.0% higher rates at the oldest age.

Beyond this exercise, carriers may be left with a decision regarding relative rate levels for Plan F and Plan G. This decision will be influenced by the clarity of regulation as 2020 approaches. Consideration should be given to expectations of how population segments migrate to or from each plan. For example, assuming that Plan G becomes available under the various guaranteed issue provisions, will a shift in underlying demographics and morbidity level put upward pressure on claims? For Plan F, to what extent will the aging of in-force business be offset by future sales, which are 100% subject to medical underwriting? The only Plan F sales will be to applicants ages 66 and older who are subject to medical underwriting and were covered by Medicare Parts A and B prior to January 1, 2020. This could result in interesting developments regarding the rate differential between Plans F and G.

Evaluation of other rating structures

Beyond the Plan F versus Plan G comparison, there is the opportunity to evaluate and possibly modify other rate relativities. The previous section touched on recognition of underlying age relativities. This section expands that discussion to the general current practice of Medicare Supplement industry rating and the extent to which current rating may contain inherent misalignment and subsidization across rating cells.

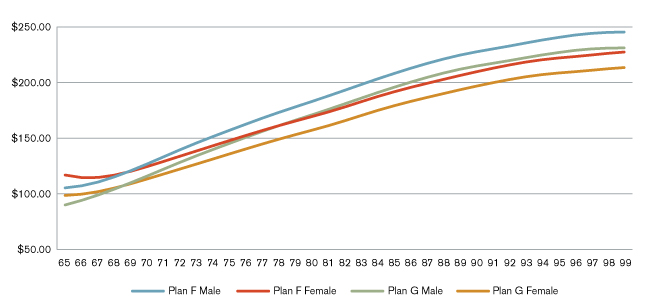

The chart in Figure 5 provides age and gender slopes of estimated per member per month (PMPM) claim costs developed from internal research and analysis of the CMS Medicare 5% sample data set (years 2011 to 2013).

Figure 5: Estimated Age-Gender PMPM Claim Costs

These results provide two key observations beyond the expected overall increasing slope for each gender. First, female claim costs are higher than male claim costs until age 69 for both benefit plans. Second, we observe that female claim costs actually exhibit a decreasing slope from age 65 to age 66 for Plan F benefits. As medical expense levels are expected to generally rise with age, this result might be surprising. However, one hypothesis is that age 65 (and perhaps to a lesser extent age 66) claim costs contain pent-up demand as individuals enroll in Medicare and gain access to insured healthcare for the first time. Perhaps this influence will dampen with the availability of guaranteed issue and subsidized Patient Protection and Affordable Care Act (ACA) health plans in the commercial market. In addition, age 65 is the first year of Medicare eligibility due to age and would incorporate more coverage exposure consisting of less than a full year.

While the underlying data reflects all Medicare beneficiaries beyond Medicare Supplement membership, these observations are inconsistent with typical Medicare Supplement rating practices. Medicare Supplement rate schedules typically increase consistently by age, and female rates are generally a flat percentage discount off male rates, in the neighborhood of 10%, varying by carrier3. Our observations of the overall age slopes and gender relativities might shed some light on the inherent subsidies and vulnerabilities of rate structures to assumed age-gender distributions. Carriers in the industry may find value in evaluating experience by various rating cells in order to gain a better understanding of what drives performance. This might reveal levels of subsidization, which results in in-force and sales distributions that are skewed toward lower-priced (yet unprofitable) rating cells in spite of overall rate level adequacy.

Keep in mind that any rating modifications are subject to state regulation, the extent of which varies significantly by state. State-specific regulations and requirements for rate modifications are beyond the scope of this report.

Limitations

These results are provided for presentation purposes only. Actual company claim cost levels will depend on various factors, including but not limited to time period, geographic area, morbidity differences, underwriting, demographics, and the overall uncertainty of future results based on past results.

In preparing this information, we relied on the CMS 5% sample data set (calendar years 2011 to 2013) and internal research. We accepted this information without audit but reviewed it for general reasonableness. Our results and conclusions may not be appropriate if this information is not accurate. Our analysis uses Medicare data across all Medicare enrollees included in the 5% sample data set and does not segment actual Medicare Supplement policyholders, in particular policyholders of Plan F or Plan G.

Guidelines issued by the American Academy of Actuaries require actuaries to include their professional qualifications in actuarial communications. I, Kenneth L. Clark, am a consulting actuary for Milliman, Inc. and am a member of the American Academy of Actuaries. I meet the qualification standards of the American Academy of Actuaries to render the analysis contained herein.

The opinions expressed in this report are those of the author alone and do not necessarily reflect the opinions of Milliman or other employees of Milliman.

Appendix A: Case Study Assumptions

Lapse rates

Annual voluntary lapse rates assumed are as shown in the table in Figure 6.

Figure 6: Lapse Rates Assumed

| Duration | Annual Voluntary Lapse Rates |

| 1 | 12.0% |

| 2 | 9.0 |

| 3 | 8.0 |

| 4+ | 6.0 |

Mortality

Mortality is assumed to be the 2000 US Life Population sex-distinct Mortality Tables.

Claim trend/rate increases

Future annual claim trend and rate increases of 3.5% are assumed.

Underwriting

The underwriting selection factors shown in the table in Figure 7 are applied to policies subject to medical underwriting.

Figure 7: Underwriting Selection Factors

| Policy Year | Underwriting Selection Factor |

| 1 | 75.0% |

| 2 | 87.5 |

| 3+ | 100.0 |

The percentage of policies subject to medical underwriting varies by issue age as shown in the table in Figure 8.

Figure 8: Underwriting Percentage by Issue Age

| Issue Ages | Distribution |

| 65 | 0% |

| 66-69 | 50% |

| 70-74 | 75% |

| 75-79 | 80% |

| 80-84 | 90% |

| 85+ | 100% |

Demographics

Issue age demographic assumptions are as shown in the table in Figure 9.

Figure 9: Issue Age Demographics

| Issue Age | Male | Female |

| 65 | 17.9% | 21.9% |

| 66 | 5.4 | 6.6 |

| 67 | 3.6 | 4.4 |

| 68 | 2.7 | 3.3 |

| 69 | 2.3 | 2.8 |

| 70 | 1.8 | 2.2 |

| 71-74 | 5.4 | 6.6 |

| 75-79 | 3.2 | 3.9 |

| 80-84 | 1.8 | 2.2 |

| 85-89 | 0.9 | 1.1 |

| All | 45.0% | 55.0% |

Discount rate

For purposes of calculating present values, we assume a 4.0% discount rate.

1Public Law 114-10-Apr. 16, 2015; 129 Stat. 87. Congressional Record. Vol. 161 (2015). Retrieved January 21, 2016, from https://www.congress.gov/114/plaws/publ10/PLAW-114publ10.pdf

2The same fate will impact Plan C. However, as noted, for purposes of our discussion, we will focus on Plan F.

3It is not uncommon for carriers to use unisex rating.