The rule notes that one of the main goals of the MSSP is to save Medicare money, and takes steps to limit risk avoidance strategies and encourage plans to share in both savings and losses.

On August 8, 2018, the Centers for Medicare and Medicaid Services (CMS) released a proposed rule that will significantly change the Medicare Shared Savings Program (MSSP) if enacted.1 This is the eighth in a series of Milliman white papers on the proposed rule and focuses on integrity and cost-effectiveness.

In recent years, political discourse has increasingly become a matter of “red” versus “blue.” Yet there are politicians of all stripes who support Medicare regardless of their tribe. Equally so, politicians of all stripes agree that the Medicare Trust Fund faces severe headwinds—the 2018 annual Medicare Trust Fund report suggests that the Trust Fund will run out of money in 2026.2 While this does not mean that Medicare will run out of money,3 stakeholders on all sides are interested in ensuring that Medicare’s costs increase as slowly as possible to prolong the life of the Trust Fund and reduce the need for future program cuts or any increases in revenue or premium. This objective underlies several facets of the MSSP proposed rule, and in particular is addressed by the rule’s provisions related to the guiding principle of integrity.4 In light of this, we discuss ways in which accountable care organizations (ACOs) have been identified by CMS as weakening this integrity and how CMS is proposing to address these concerns.

Trust Fund babies: ACOs, the MSSP, and the Medicare Trust Funds

As mentioned in the MSSP proposed rule, “shared savings program ACOs are an important innovation for moving CMS’s payment systems away from paying for volume and towards paying for value and outcomes.” By allowing ACOs to share in any savings achieved for individuals under their care, the MSSP creates incentives for providers to help control the increase in healthcare costs for the Medicare population, and therefore extend the life of the Medicare Hospital Insurance Trust Fund and help stave off future Medicare Part B premium increases. In order to encourage ACOs to participate in the MSSP, the initial structure of the program allowed ACOs to avoid sharing any losses for a limited time, so that ACOs could experiment with the MSSP without facing potentially serious financial outcomes if they were not able to achieve savings. As might be expected, this program structure opened the door for ACOs to act in their own best interests rather than that of the Trust Funds.

Don’t hate the player: ACO strategies under the current rules

In the MSSP proposed rule, CMS identified several ways in which it believes ACOs are acting within the letter of the rules of the MSSP but not necessarily within the spirit. Some of the methods described by CMS are based on the ability of ACOs to reinvent themselves as new ACOs. Reinvention is most simply done by an ACO recreating itself under a new Taxpayer Identification Number (TIN), but could also be achieved by making changes that CMS would determine to be significant enough to effectively result in a new ACO. When an ACO reinvents itself, the current rules allow the ACO to start over in the MSSP with a fresh slate.

Prolonging one-sided agreements

Under the rules currently in place, ACOs can elect to participate in a one-sided agreement for the first six years in the MSSP. Because the MSSP started in 2012 and was not fully in place until 2013, 2018 represents the last year of one-sided agreements for MSSP early adopters. However, an ACO that reinvents itself resets all agreement counters and can elect to start over in year 1 of a new one-sided agreement period. This opportunity is part of the rationale for the scope and focus of many of CMS’s changes to the program, particularly in light of CMS’s belief that ACOs, and particularly one-sided ACOs, may not be saving the Medicare program any money.5

Additionally, ACO participants were not limited in their ability to reenter a program with one-sided risk even if they had participated in a program with two-sided risk. In theory, providers could “hop around” various ACOs and avoid taking on any two-sided risk unless they elected to do so.

Optimizing the benchmark

Every ACO has a clearly defined performance benchmark, but the calculation of the benchmark opens the possibility for ACOs to modify their benchmarks through reinvention or other changes. In particular, ACOs can seek to modify the weighting of experience as well as the use of regional growth rates in the benchmark calculation.

The start of a new agreement period also triggers a reset of the ACO’s performance benchmarks. Because benchmarks for the initial agreement period are weighted 60% on the third benchmark year, 30% on the second benchmark year, and 10% on the first benchmark year, an ACO with higher-than-usual experience in a given year could artificially inflate its benchmark by starting a new agreement period. All else being equal, the savings attributed to it under the MSSP would also be inflated. However, effectively implementing this strategy presents certain logistical challenges as experience for the full year is not available when an ACO would need to decide to apply for a restart.

Under the current rules, regional growth rates are only reflected in benchmarks in the second and subsequent agreement periods. If an ACO’s regional benchmarks are lower than those that would be calculated with the national growth rate used in the first agreement period, the ACO could reinvent itself and thus earn benchmarks using the more favorable methods.

Alternatively, an ACO could accelerate its transition to regional adjustments through a merger with an ACO in a later agreement period if regional benchmarks are more favorable than the national growth rate, though this would also accelerate the ACO’s transition to two-sided risk, and thus may not be as appealing a course of action.

Both strategies around regional benchmarks present additional issues given the nature of regional growth rates—a regional growth rate that is higher or lower than the national growth rate in a given time period does not guarantee that the same relationship will hold in future years.

Advantages of program participation

CMS comments that ACOs have certain advantages as a result of program participation even if they do not achieve shared savings. With the availability of additional performance data from the initial years of the MSSP, CMS noted that it may be appropriate to structure the program so as to limit the benefits of ACO participation to ACOs that are demonstrating financial success under the program.

Limited loss avoidance incentives

In the proposed rule, CMS noted that ACOs that have incurred losses in more than one year of their first agreement periods but have been allowed to participate in a second agreement period have generally not shown the ability to generate meaningful savings in that second period, particularly when part of a one-sided agreement. CMS claims that these ACOs are benefiting from the MSSP in the form of receiving program data and access to certain types of contracting arrangements without providing any “meaningful benefit to the Medicare program,” unlike ACOs in two-sided agreements that must be willing to share in losses in order to receive these same benefits.

Provider/facility coordination

CMS also expressed concerns about ACOs that included facilities on their ACO participant lists. Based on their analyses, these ACOs (which typically incurred a higher CMS also expressed concerns about ACOs that included facilities on their ACO participant lists. Based on their analyses, these ACOs (which typically incurred a higher percentage of their assigned enrollees’ revenue) did not generate meaningful savings under the MSSP. CMS noted that these ACOs may have fewer incentives to reduce costs as any savings generated by a reduction in costs are offset by a reduction in revenue. These ACOs may also be incentivized to expand their participant lists to drive more traffic to their facilities, in essence consolidating healthcare in the market.

Playing favorites: New ACO classifications and risk-taking

As a way to address some of the unintended consequences under the current rules, CMS is proposing significant modifications to the way it evaluates ACO applications and determines participation options for the BASIC and ENHANCED tracks.

Renewing, reapplying, and new

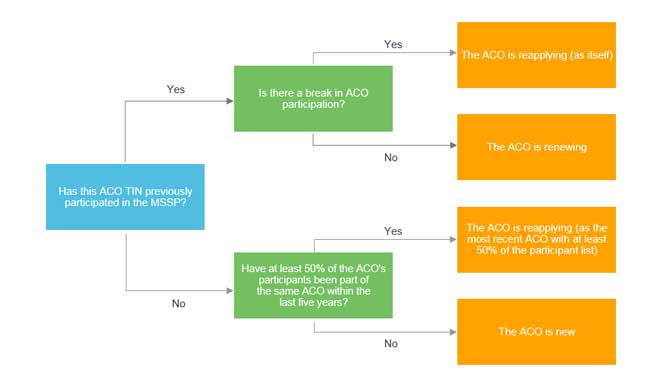

In order to limit the ability of ACOs to reinvent themselves, CMS created a more explicit hierarchy for evaluating when an ACO is truly applying for the first time. Under the proposal, CMS will determine renewing ACOs as those applying under the same TIN for an agreement period that would not result in a lapse in MSSP participation (including voluntary terminations in order to immediately enroll in the BASIC or ENHANCED tracks). ACOs that use a TIN that has already been part of the MSSP (but do not meet the criteria to be classified as a renewing ACO) are determined to be reentering as are ACOs where greater than 50% of participants (as measured by the TINs included on the ACO’s participant list) participated in the same ACO within the past five performance years. This ensures that an ACO whose composition is materially similar to an ACO with recent participation in the MSSP is treated as a continuation of that prior ACO. In effect, these proposed classifications limit the ability for an ACO to modify itself sufficiently to become a new ACO; only ACOs that fail to meet both of these criteria can be considered new ACOs.

Figure 1: ACO application classification

Under the proposed rule, both renewing and reentering ACOs would be treated as continuations of the prior ACO. Renewing ACOs would enter at the next agreement period as is currently the case. Reentering ACOs would either enter in the same agreement period (if the prior ACO terminated participation in the middle of an agreement period), the next agreement period (if the prior ACO terminated at the end of an agreement period), or the current agreement period (if the prior ACO is still participating in the MSSP). This agreement period would dictate track eligibility, benchmark determination, and use of regional benchmarks.

Once at risk, always at risk

In addition to formalizing when an otherwise new-looking ACO is the same as a previous ACO, the MSSP proposed rule attempts to limit the ability for ACOs and ACO participants to leverage prior experience with two-sided risk in a one-sided program. Under the proposed rule, if an ACO either has experience with a two-sided program,6 or if at least 40% of the ACO’s participants have such experience, the ACO is prevented from entering into the BASIC track’s glide path.

If you don't save money, you may pay the price

Less obviously related to the strategies identified above, the MSSP proposed rule established a new financial performance review criteria whereby an ACO that incurs significant losses in more than one performance year in a given agreement period may be terminated from the MSSP. “Significant” is determined based on the ACO’s minimum loss rate (MLR) or minimum savings rate (MSR) in the case of a one-sided ACO. An ACO with losses that exceed the MLR (or with a negative MSR for a one-sided ACO) is determined to be “negative outside corridor.” CMS indicated that being negative outside corridor in two or more years tends to result in: 1) inflated benchmarks in future years (which are based on expenditures in years with significant losses), and 2) affected ACOs generally not achieving shared savings in those future agreement periods. This financial performance review criteria seems to address those ACOs participating for less tangible reasons than generating savings (for example, gaining access to data and/or the ability to contract with other participants).

What you control will control you

In response to their concerns about ACOs that incorporated facilities, CMS created a revenue-based distinction that affects participation options for ACOs. ACOs that are “low-revenue” (i.e., revenue for ACO participants is less than 25% of total Medicare Parts A and B fee-for-service [FFS] expenditures for assigned beneficiaries) are allowed to apply for a second agreement under the BASIC track (under level E for all years), while other “high-revenue” ACOs must enroll in the ENHANCED track for the second and any subsequent agreement periods. According to self-reporting data cited by CMS, the 25% revenue threshold sorts 96% of ACOs into “low-revenue” or “high-revenue” consistent with a facility-based definition, and correctly sorted all physician-only ACOs. This proposal appears to be tailored to place at least some disincentive on provider consolidation.

Don’t betray our trust (fund): Where do we go from here?

The MSSP proposed rule makes clear that CMS wants ACOs to participate, but also that it will hold these accountable care organizations… accountable. The original MSSP clearly contemplated the temporary nature of one-sided agreements, and many of the changes in this proposed rule were perhaps overdue in light of the extension of one-sided arrangements under the August 2015 final rule. It seems almost certain that these changes will reduce the impact that ACO losses may have on the health of the Medicare Trust Funds, but may also inhibit overall program potential if ACO participation decreases. After all, the MSSP must have a sufficient volume of savings to make a meaningful impact, and ACOs must weigh the potential for losses resulting from poor execution against the potential for losses due to circumstances outside of their control. And with widespread public disagreement with CMS’s approach to measuring savings,7 questions remain as to the extent of any impact the proposed rule will have on the Trust Funds.

Bolstering the integrity of the MSSP is a complex task. And when combined with the already complex nature of policy-making, it’s unlikely that the proposed rule will perfectly address CMS’s concerns without creating unintended consequences. In order to address these unintended consequences, the pursuit of integrity and accountability within the MSSP will need to be continuous and evolving.

1CMS (August 17, 2018). Proposed Rule: Medicare Program; Medicare Shared Savings Program; Accountable Care Organizations—Pathways to Success. HHS. Federal Register. Vol. 83, No. 160.

2The Boards of Trustees, Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds. 2018 Annual Report of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds. Retrieved on September 19, 2018, from https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/ReportsTrustFunds/Downloads/TR2018.pdf.

3Van de Water, P.N. (July 3, 2018). Medicare Is Not Bankrupt. Center on Budget and Policy Priorities. Retrieved on October 23, 2018, from https://www.cbpp.org/sites/default/files/atoms/files/7-12-11health.pdf.

4As used in both the rule and this article, integrity refers to actions that attempt to maintain accountability and cost-effectiveness of the rule. This treatment of integrity should not be equated with program integrity as embodied by CMS’s Center for Program Integrity, which focuses on fraud and abuse.

5As discussed by Seema Verma in her remarks to the American Hospital Association on May 7, 2018. Retrieved on September 24, 2018, from https://www.cms.gov/newsroom/fact-sheets/speech-remarks-cms-administrator-seema-verma-american-hospital-association-annual-membership-meeting

6Most Medicare ACO programs are considered two-sided, though most ACOs are enrolled in Track 1 of the current MSSP

7See, for example, McWilliams et al. (2018). Medicare spending after 3 years of the Medicare Shared Savings Program. N Engl J Med 379:12, 1139-1149.