A fundamental function of reinsurance is to provide financial recovery from natural catastrophes. By its nature, catastrophe risk is often not diversifiable on a local or even regional scale. Instead, insurers usually look to the global reinsurance markets for catastrophe risk protection.

Increasingly, alternative capital participants (e.g., hedge funds and pension funds) are investing directly in catastrophe risk, utilizing instruments such as insurance-linked securities (ILS). In certain situations, these arrangements may offer a lower cost and more efficient form of catastrophe risk financing than traditional reinsurance.

The alternative capital market is still small compared to the capacity offered by traditional reinsurers. Nevertheless, the introduction of alternative capital has already had major impacts on the supply and price of catastrophe reinsurance. Further, the biggest changes may be ahead: Analysts predict the alternative capital market will double or triple in size over the next few years.

Alternative capital’s success derives from its ability to offer highly competitive prices. Price competition has proven a successful path to growth: Alternative capital is a major contributor to recent year-over-year price drops of 20% or more on some catastrophic risks. However, this rate of change is not sustainable over the long run—all markets must have a floor. In fact, there is some evidence that prices on several key perils are already approaching investors’ minimum return thresholds. Thus, the alternative capital market must design a new generation of innovative products to maintain its current trajectory.

There are many potential avenues for innovation: Alternative capital investors now contend with a number of market barriers and shortcomings as is to be expected for any relatively new asset class. One key obstacle is the constrained range of risk profiles for alternative capital assets. While the varieties of investable catastrophe risks (e.g., U.S. hurricanes or Japanese earthquakes) vary greatly, the range of risk quality on catastrophe bonds is much narrower. Most existing catastrophe bonds have credit ratings between BB- and BB+, representing the risk layer that insurers are typically willing to cede. As a result, the lack of investment-grade (BBB+ or higher) catastrophe risk on the market may restrict the options of any portfolio managers with limitations on the amount of speculative-grade risk they may hold. Conversely, relatively few bonds have come to market with a high level of riskiness (e.g., a probability of default greater than 5%) as these risk levels are generally covered by working layers of reinsurance.

Insurance and CDOs

Catastrophe risk markets can create a broader range of investment opportunities, including both very low risk, highly rated catastrophe instruments as well as low-rated, higher-yielding instruments, through the use of collateralized debt obligations (CDOs).

Given the somewhat infamous legacy of CDOs and the inherent complexity of catastrophe risk, the pairing of the two in a collateralized risk obligation (CRO) may appear problematic. However, catastrophe risk is a far stronger candidate for inclusion in a CDO-type structure than economic assets such as securitized mortgages.

Consider the basics of a CDO and the factors that led the pre-crisis CDO market to collapse. At its core, a CDO is similar to an insurance company. Both pool a large number of individual risks and rely on the law of large numbers (the “insurance principle”) to diversify away a significant portion of the risk. In addition, both pay certain parties first (senior trancheholders for the CDO and claimants for the insurer), with any remaining funds made available to equity trancheholders or shareholders.

CDOs generate new investment opportunities because the most senior CDO tranches typically receive credit ratings far in excess of the ratings of the underlying collateral. These high ratings proved to be illusory for the pre-crisis market of subprime mortgage-backed CDOs. An appropriately designed CRO would be significantly more robust than these pre-crisis CDOs for three reasons.

First, a sufficiently diversified portfolio of catastrophe risk does not suffer from the same systemic vulnerabilities that affected the mortgage markets. Unlike housing markets—which are affected by the state of the economy—there is no single “macro factor” that is responsible for all natural catastrophes. Instead, well-designed CROs would enjoy geographic diversification: For instance, Asian typhoon activity is not fully correlated (and, in fact, may be inversely correlated) with North American hurricane activity.1 A catastrophe risk pool may also benefit from typological diversification. Natural disasters can be geophysical (e.g., earthquake), meteorological (e.g., convective storms and tropical cyclones), or even climatological (e.g., drought) in nature.2 Each type is driven by forces that are not fully correlated—and often may not be correlated at all. For example, the occurrence of a Japanese earthquake is unlikely to impact the likelihood of a major U.S. hurricane.

Second, the modeling process for a CRO should be more robust and transparent than that for pre-crisis CDOs. Pre-crisis CDOs often contained pieces of thousands of individual mortgages, requiring major simplifying assumptions to make the pricing model tractable. Often, reliance was placed on some form of the normal distribution and a single, catch-all assumption of constant correlation across the entire structure. ILS such as catastrophe bonds are significantly larger than individual mortgages, and relatively fewer are required to create a financially viable pool. In conjunction with the existing structural risk models for natural catastrophes, this allows for more nuanced pricing techniques to represent the asset interdependencies within the pool.

Third, incentives for CRO cedents are aligned with the incentives of the CRO investor. In the subprime boom, mortgage originators and CDO underwriters were paid based on volume and often retained none of the ultimate risk, giving them every incentive to prioritize quantity over quality when structuring CDOs. In contrast, the “originators” of catastrophe risk are insurers, who retain the first-dollar exposure on their policies (and often a pro rata share of the excess reinsured catastrophe loss). This retention of risk should serve to align the interests of market participants in a way that was never present in the pre-crisis CDO market.

Case study

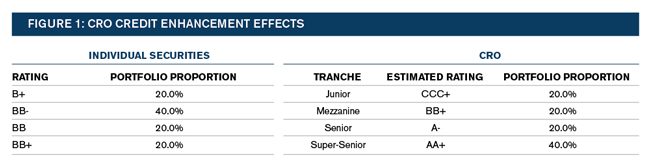

Consider a theoretical CRO collateralized by five different catastrophe assets, each rated between B+ and BB+ (a range of speculative-grade ratings). Even with these few assets, a CDO-type structure can create a significant amount of investment-grade risk. For the sake of this case study, we constructed a simplified copula simulation process to model a simple four-tranche structure. The results are shown below in Figure 1.

There are at least three important takeaways from this example.

First, the CRO generates a significant amount of investment-grade catastrophe risk from a portfolio composed entirely of securities with non-investment-grade ratings. In fact, fully 80% of the tranched CRO capital receives a rating equal to or higher than the highest rating for an individual security.

Second, the CRO also generates a sizeable amount of “junk” risk with a significantly lower rating than any of the collateral securities. In this case, the default profile of the junior tranche ends up riskier than existing investment opportunities across most of the catastrophe bond market. In the case of the reinsurance markets, this actually may be a benefit. With yields down across the board, there is some evidence that specialist investors may have a sizeable appetite for potentially high-yielding catastrophe risk investments. In fact, one tranche of a recent USAA Residential Re catastrophe bond had a comparable probability of default to the sample junior tranche. It priced at one of the lowest ratios of coupon-to-expected loss yet seen in the market.

Third, the CRO—while a powerful tool for credit enhancement—is less “potent” in creating high-rated securities than pre-crisis CDOs, largely because of the relatively low number of collateral securities. Note that the super-senior tranche of the sample CRO receives an AA+ rating compared to the high proportion of “AAA” risk that was the hallmark of pre-crisis CDOs.

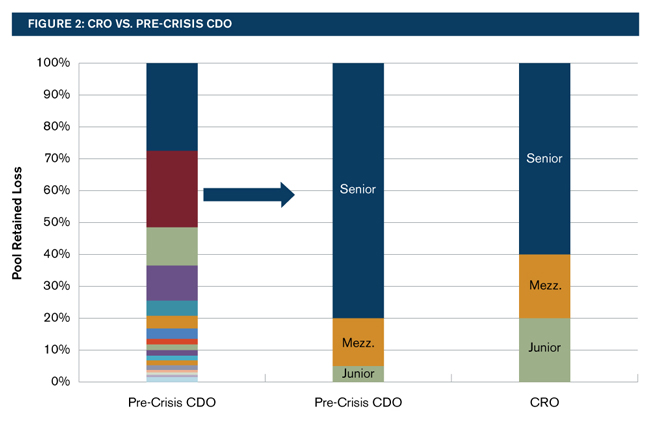

To illustrate, Figure 2 compares our sample CRO to a 2006 subprime mortgage-backed CDO described in the financial crisis literature.3

On a proportional basis, the difference is most striking between the sets of junior tranches, which make up 20% of the CRO but only 3% of the pre-crisis CDO. Most of this difference flows through to create additional senior tranches in the pre-crisis CDO.

It is worth noting the benefits that the CRO enjoys from its reduced leveraging: Increased transparency and model comprehensibility that are due to the low number of collateral assets. Each should help promote the market appeal and long-term viability of the CRO.

Conclusion

The market for alternative capital has grown substantially over the past several years and is poised to expand further, but faces headwinds as yields begin to approach minimum acceptable thresholds. The market’s long-term success will be closely tied to its ability to create new products, improve existing products, and overcome barriers to expansion.

The CRO offers a powerful tool for generating new investment opportunities from the existing catastrophe risk markets. Comparisons to the pre-crisis CDO collapse are inevitable—and necessary—in order to thoughtfully design a robust and stable CRO. Nevertheless, the comparison reveals that catastrophe risk markets are well-suited to CDOs in ways that pre-crisis subprime mortgage markets never were.

The CDO is built upon the principles that have served as the foundation of the insurance industry since its inception. By tapping into the depth of the broader financial markets, catastrophe risk is spread over the broadest diversifying pool. As the alternative capital market continues to mature, the application of CDO-type structures to catastrophe risk may not only be a valuable tool—but also a natural one.

For more information please see the extended report published in the Casualty Actuarial Society's Spring 2015 E-Forum.

1Maloney, E. & Hartmann, D. (2001).The Madden-Julian Oscillation, Barotropic Dynamics, and North Pacific Tropical Cyclone Formation. Part I: Observations. Journal of the Atmospheric Sciences.

2Among other types not listed.

3Barnett-Hart, A.K. (March 19, 2009). The Story of the CDO Market Meltdown: An Empirical Analysis. Harvard College: Cambridge, Massachusetts.