This is the first article in a four-part series to introduce the broader concept of risk adjustment management.

Risk adjustment is a big deal for issuers providing Patient Protection and Affordable Care Act (ACA) coverage to individuals and small employers. Some of our internal studies highlight how significant1 and volatile2 risk adjustment can be, even for a carrier of meaningful size. We found that many issuers participating in the ACA have not put in sufficient effort to create a deliberate, comprehensive risk adjustment strategy, which could be leading to lost opportunities and less certain financial outcomes.

For issuers without a game plan, it may seem like a steep hill to climb. However, we aim to provide the proverbial wind at your back to help you focus your efforts more confidently. Our task in this paper, the first in a four-part series, is to introduce the broader concept of risk adjustment management and highlight actions you can take to maintain its long-term success. Then, in three more detailed and topic-specific papers that follow, we focus on the pieces underlying a robust program, including the External Data Gathering Environment (EDGE) server, medical record accuracy and coding completeness (CC), and targeted risk analytics.

Let’s kick-start the program

At the start of the ACA in 2014, every issuer began assessing the business implications of risk adjustment—many for the first time. Even those with extensive experience offering products in risk-adjusted markets had to rethink their strategies and account for new processes and technologies. Four years later, many issuers remain in the same position as they were in the beginning, while others have thrown in the towel altogether.3

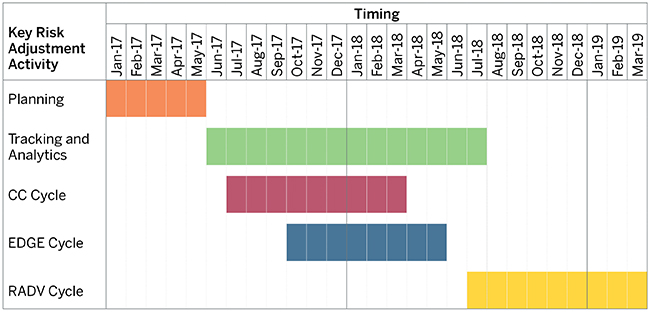

The most successful risk adjustment management programs tend to be planned, firm-wide initiatives that recognize and account for the dollars at stake, the degree of government scrutiny, and the amount of people, processes, and technology involved. Each activity has many components, which occur throughout the benefit year and extend over the subsequent two years. The timeline in Figure 1 represents a typical risk adjustment cycle,4 in our example for benefit year 2017. We include timing for the Risk Adjustment Data Validation (RADV) process when the Centers for Medicare and Medicaid Services (CMS) evaluates the accuracy of both submitted issuer data and claim record diagnosis codes and possibly adjusts risk transfers in a future year.

Figure 1: Sample risk adjustment timeline for benefit year 2017

The breadth of the tasks and length of the commitment can be daunting, so several functional areas should be engaged in the effort—each responsible for a piece of the process but all working in lockstep to achieve the common goal. While different issuers will undoubtedly have unique structures, commonly involved areas include medical management, information technology (IT), actuarial, finance, pharmacy management, compliance, provider relations, network management, and marketing. Some functions may be fully or partially delegated to third parties. But keep in mind that an external business relationship will require considerable oversight to ensure the results meet expectations or contractual obligations.

All functional areas, processes, technologies, and vendors touching risk adjustment preferably have either a direct or indirect reporting structure to one owner who is ultimately accountable for the program. Without this single source of oversight across the entire chain, issuers run the risk of resource inefficiency and priority misalignment.

Sink or swim?

Because ACA risk adjustment is zero-sum, ineffective management directly benefits your competitors. Additionally, approaching it strictly behind a lens of “compliance” and not targeting a best-in-class solution will likely worsen your relative risk adjustment position over time, as other issuers in your market develop long-term risk adjustment strategies—and catching up will require much more effort in the long run.

Without clear ownership and the right level of insight, you will likely be in a worse position to realistically assess your company’s performance, potentially impairing your ability to make timely financial and operational decisions. There is significant money at stake in ACA risk adjustment. With the appropriate approach, firm oversight, dedicated resources, and the right technology, it can be less difficult (and less mystifying) to maximize the amount your organization receives and to improve your plan’s market position over time.

Stay up to the task

As noted, this paper is the first in a four-part series examining the most important components of risk adjustment management and highlighting both best practices and actionable items. Below is a synopsis of the core areas of focus for issuers today.

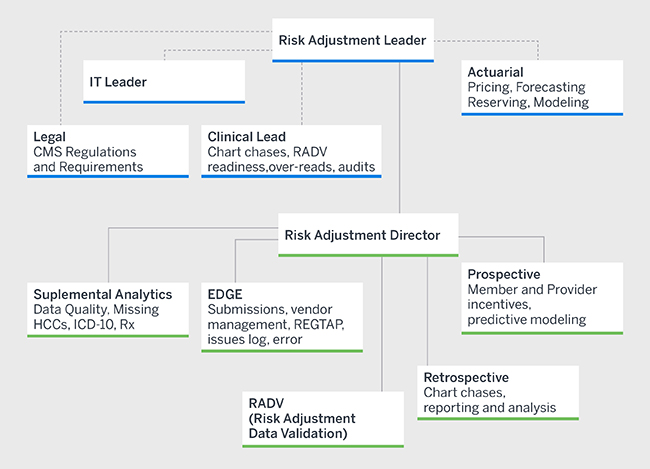

Accountability: Visible ownership and strong administration are important elements of risk adjustment management. A significant portion of the internal process involves engaging active parties. Program execution will be enhanced by involving a stakeholder from each functional area during strategy development and after securing buy-in on scope and direction up-front. Refer to the Appendix for a graphic depicting an example ownership structure.

Be active in your planning. Plan early; plan continually; plan with all key stakeholders.

Lastly, develop a transparent and well-communicated plan for every aspect of the process, such as reporting and tracking frequency, roles, and timing of key deliverables.

External Data Gathering Environment (EDGE) server: The EDGE server is the technology CMS uses to collect information for calculating risk transfers in states subject to the federal risk adjustment model. Issuers must submit risk-adjustment-eligible data or be assessed a risk adjustment default charge (RADC) and possibly be subjected to other penalties.5

All roads lead to the EDGE server in the current ACA marketplace. Whether hosting and managing a server internally or partnering with an external vendor, issuers are ultimately responsible for all EDGE server processes, including submission timelines, reconciliation, baseline reporting, and auditing. Failure to meet EDGE obligations could unnecessarily leave money on the table.6

Coding completeness: Increasing medical record coding accuracy will improve member outcomes and optimize issuer risk transfers. As such, coding initiatives should play an integral role in risk adjustment management strategy. Issuers should consider both provider and member incentives where possible to increase the likelihood of achieving desired outcomes. Remember, though, coding completeness is a two-way street, and issuers need to address errors leading to both too few and too many diagnoses.

Strategies for increasing coding completeness commonly involve retrospective chart reviews. However, issuers should not overlook prospective approaches, such as member outreach or embedding suspected member conditions into electronic health records (EHRs) and physician workflows. Because inaccurate diagnoses can materially impact risk transfers,7 it’s easy to see how concentrated efforts in this area can add up quickly.

Reporting, tracking, and analysis: Reporting and analytics should feed every aspect of risk adjustment management and may include risk score benchmarking, forecasting, EDGE server reconciliation and auditing, and pricing and filing strategies. Meaningful analysis requires planning and proper timing to align with key elements in the risk adjustment timeline. Lack of monitoring inevitably leads to missed opportunities and uninformed decisions. For example, in our risk analytics paper,8 we discuss the emphasis CMS has begun to place on formulary transparency and prescription drug risk and why issuers need to factor this information into their ACA strategies going forward.

Risk analytics also forms the backbone of coding completeness initiatives, whether through statistical models to identify missing or inaccurate diagnoses or through return on investment (ROI) analyses to evaluate program performance.

Time to go the extra mile

Risk adjustment should be a core area of expertise in the ACA. Each issuer should strongly consider its risk adjustment strategy or jeopardize creating an unsustainable expense out of what should be valuable, revenue-generating activities. It’s time to go the extra mile and consider how going “all-out” can increase the success of your program.

In each of the subsequent papers in this series, we discuss strategies for one of three key components of the ACA risk adjustment management framework—the EDGE server, coding completeness, and tracking and analytics—and suggest ways to achieve improved outcomes through a combination of the right people, processes, and technology.

Appendix

The following graphic depicts a model structure of a well-organized risk adjustment management program. The functional areas responsible for each component will vary and may be integrated into similar departments, depending on issuer size and company strategy. The most successful programs tend to share two common characteristics: 1) A single owner who is actively engaged in the entire process, and 2) a multifaceted approach to understanding, projecting, and optimizing risk scores.

1Based on an internal analysis of individual market risk adjustment results from calendar year 2015 and 2016 state simulation studies, we found transfers could still be in excess of +/-10% of premium for issuers with more than 200,000 member months.

2Vandagriff, A., Petroske, J., Fink, K., & Krienke, N. (June 15, 2016). Sizing up ACA risk adjustment volatility: How the interplay between risk adjustment and issuer size influences profitability under the ACA. Milliman White Paper. Retrieved November 6, 2017, from https://www.milliman.com/en/insight/sizing-up-aca-risk-adjustment-volatility-how-the-interplay-between-risk-adjustment-and-is.

3Summerville, A. (June 27, 2017). More Americans will be without Obamacare insurance options next year as more carriers pull out. CNBC. Retrieved November 6, 2017, from https://www.cnbc.com/2017/06/27/more-americans-will-be-without-obamacare-insurance-options-next-year.html.

4Risk adjustment activities for benefit year 2017 actually began nearly two years earlier than our timeline suggests, when issuers projected future transfers for 2017 ACA rate setting. However, we focus only on those items impacting the actual score and not those related to estimation and forecasting, which extend the timeline for a given benefit year even further.

6For more information regarding efficiently maximizing EDGE server results, refer to https://www.milliman.com/en/insight/taking-the-edge-off-minimize-stress-while-maximizing-aca-risk-adjustment-through-edge-ser.

7For context, a common rule of thumb we use is a $2 to $3 per member per month (PMPM) transfer impact for every one basis point (0.01) of change in member risk scores. Given that a vast majority of the adult silver-level condition risk scores are in excess of 250 basis points, a member with an incorrectly identified or missing condition could change risk transfers by nearly $10,000 for the benefit year—and that’s for a single member with a relatively less severe risk-adjustment-eligible condition.

8 www.milliman.com/insight/2017/ACA-risk-adjustment-management-Time-to-keep-score/